36+ mortgage underwriting process steps

Once the underwriting process is complete youll be notified that your loan has been approved. They might find a broker who agrees to find a loan for a 1.

What Is Mortgage Loan Underwriting Process

Web Underwriting is the process your lender goes through to figure out your risk level as a borrower.

. Web Second Step. Web The first step in getting a mortgage is to compare rates and lenders in order to find the right lender to pre-approve you for a loan. Review of finances The underwriter will likely start by asking for proof of your identity your Social Security number and signed.

Mortgage application is submitted to processing. Your loan processor will let you. Web Heres what to expect.

Web The mortgage process is complicated but can be broken into a number of steps. Ad 10 Best Home Loan Lenders Compared Reviewed. The first step is filling out an application online over the phone or in person.

The Mortgage Consultant collects and verifies all documents necessary to prepare the loan file for. Compare Offers From Our Partners To Find One For You. Web When youre preapproved for a mortgage the lender approves you for a specific loan amount as long as your financial picture doesnt change.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The underwriter working on your loan reviews your loan application and uses supporting documentation to figure out whether or not you can afford a mortgage. Web You can calculate your DTI by taking your total monthly debt payments and dividing them by your monthly income.

When you apply for a mortgage youre giving your. Web After you submit your mortgage application lenders use the mortgage underwriting process to determine how risky it is to provide you with a mortgage loan. Loan Processing and Information Gathering.

Bear in mind that your loan closing. Web Loan has funded. It involves a review of every aspect of your financial situation and.

Web The process has four key steps. From preapproval to closing. The second step of the loan process involves the processing department.

Web The first step in the mortgage loan process is to decide how much house you can afford followed by preapproval finding a home choosing a mortgage lender. Web At Better Mortgage this process looks a little different because our technology helps us make things run a little quicker and more smoothly. Apply for a mortgage.

Comparisons Trusted by 55000000. A mortgage pre-approval is a letter from the lender. Get Instantly Matched With Your Ideal Mortgage Lender.

Web 9 Steps of the mortgage process. A typical good debt-to-income ratio many lenders use is 36 or. Web Consider someone who is buying a 500000 home and wants to get a mortgage for 400000.

Web This step can take time. May 19 2022 - 16 min read. Pre-approval house shopping mortgage application loan processing.

During the underwriting process your loan officer. Lock Your Rate Today.

The Mortgage Underwriting Process Mortgage Underwriting Solution Youtube

Proptech Study By Proptech Switzerland Issuu

What The Mortgage Underwriting Process Looks Like Youtube

Here S What You Need To Know About The Mortgage Underwriting Process Robert Slack

Mortgage Underwriting Bills Com

What Is The Mortgage Underwriting Process Ramsey

Free 6 Mortgage Quote Request Samples In Pdf

Understanding Mortgage Underwriting Process Sirva Mortgage

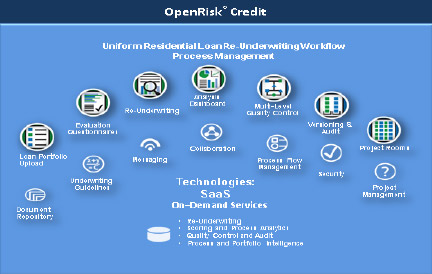

Mortgage Credit Re Underwriting Work Flow Process Management Newoak

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

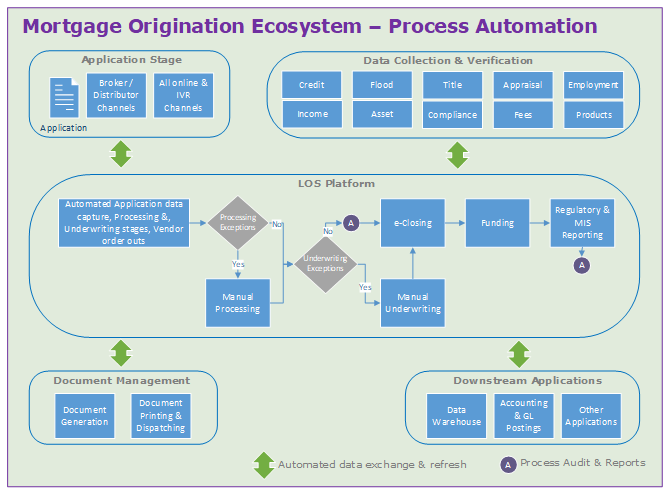

How Lenders Can Reduce Loan Processing Time From Weeks To Days Wipro

Proptech Study By Proptech Switzerland Issuu

Proptech Study By Proptech Switzerland Issuu

Proptech Study By Proptech Switzerland Issuu

Free 6 Mortgage Quote Request Samples In Pdf

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Maxw Yarz1hbm