Usps retirement calculator

112 percent of the high3 average pay and multiply the result by 5 years of service. Calculate Your FERS Retirement Date.

Sick Leave Conversion Chart U S Geological Survey

The USPS retirement calculator that you can use depends on when your service date began.

. Today most postal employees are eligible to participate in one of two federal retirement benefit programs. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. The Civil Service Retirement System CSRS which provides benefits for most.

Disability Calculator USPS Disability. The postal service which has been struggling to save for retiree healthcare benefits is facing a 1 trillion deficit and is expected to have 11 billion of pension debt in. Learn how far your savings may last in retirement with this free calculator.

If you retire for disability you may be guaranteed a minimum annuity equal to the smaller of. Calculate the premiums for the various combinations of. Our Resources Can Help You Decide Between Taxable Vs.

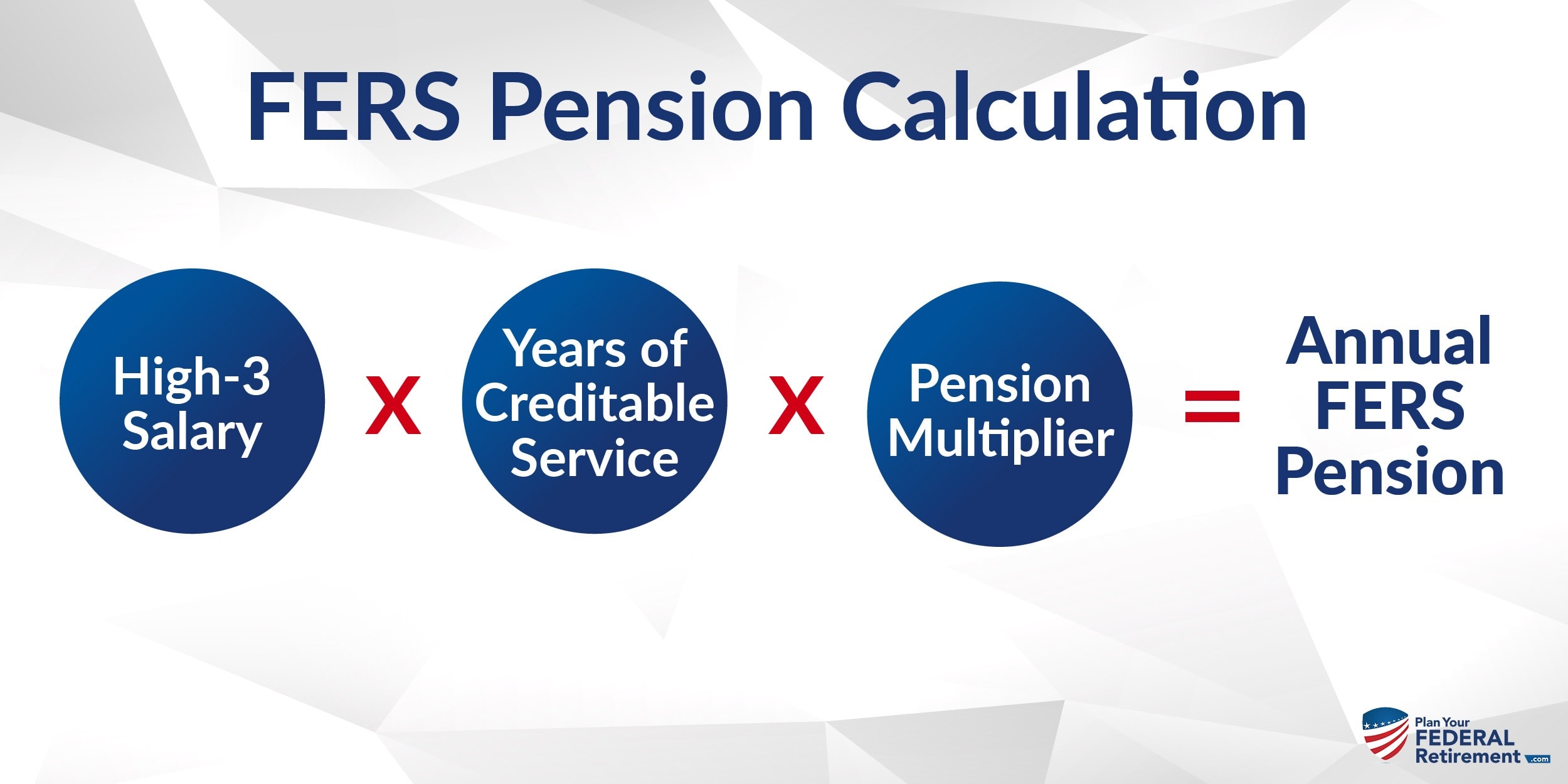

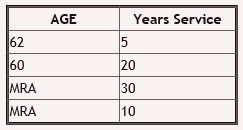

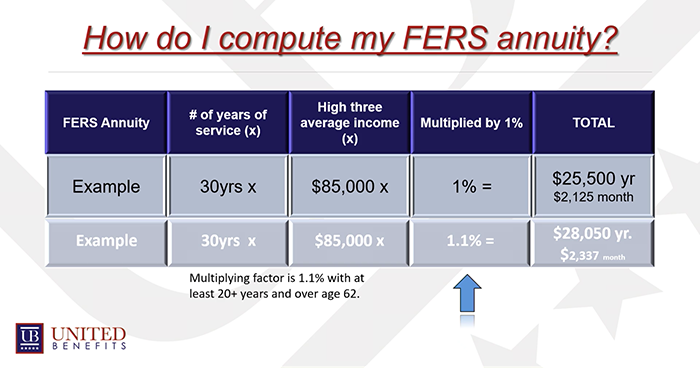

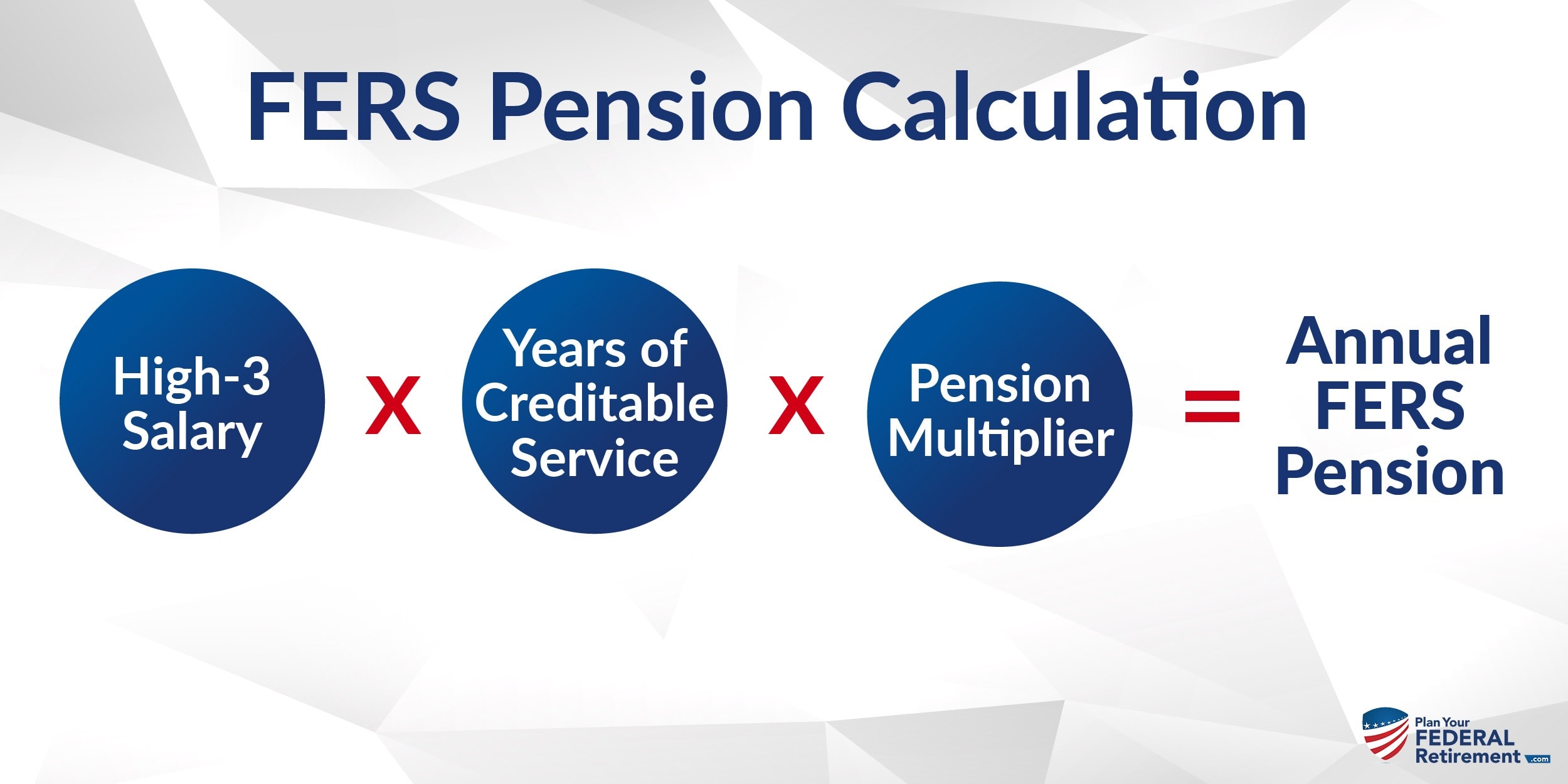

View Flat Rate Envelopes. Determine the face value of various combinations of FEGLI coverage. Your multiplier will be 1 unless you retire at age 62 or older with at least 20 years of service at which point your multiplier would be 11 a.

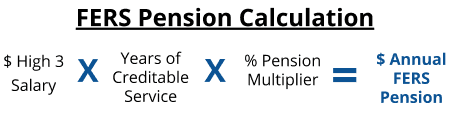

40 percent of your high-3 average salary or. Under Age 62 at Separation for Retirement OR. FERS Basic Annuity Formula.

Your multiplier is the easy part of the equation. Computation for Non-Disability Retirements. Employees credited with civilian service prior to 1989 for which no retirement deductions were withheld may make a deposit for that service.

View Flat Rate Boxes. 2021 Postal Benefits Group. Calculate price based on Shape and Size.

Federal Employees Group Life Insurance FEGLI calculator. Ad Use our free retirement calculator and find out if you are prepared to retire comfortably. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The 7 amount increases 20 cents for each full year. Age 62 or Older With Less Than 20 Years of Service.

Each 100 credited to the employees account purchases additional annuity of 7 a year for an employee retiring at age 55 or younger. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. 58532 Amount of Deposit.

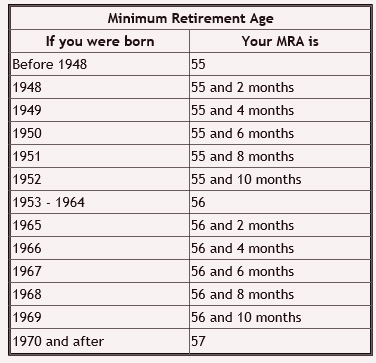

Your retirement date is based on your MRA. The standard retirement age is 65 regardless of the number of years of service. Courtesy of Attorney Robert R.

Federal Employees Retirement System. Use our FERS retirement date calculator to find the earliest date you can retire as a federal employee. If you believe that you need to consult an attorney concerning disability.

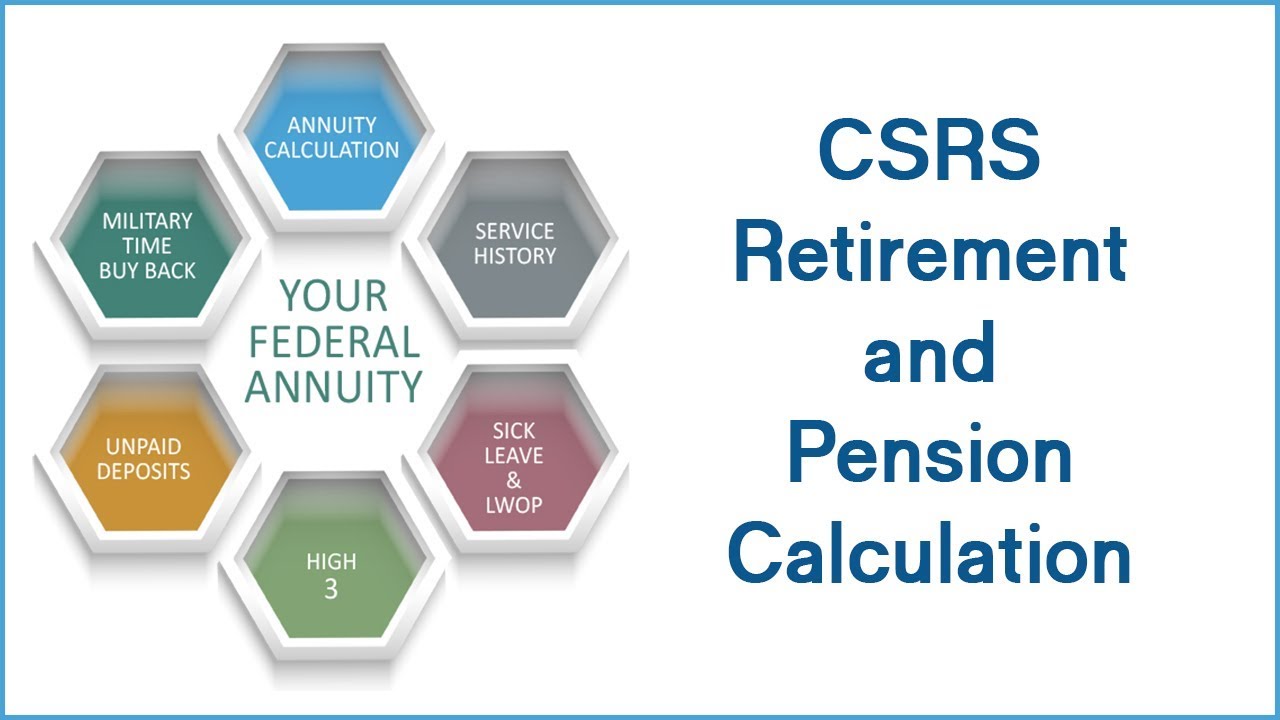

The basic annuity under the general formula is obtained as follows. Please select from the following options.

Teachers Retirement System Of Georgia Trsga

1

Mra 10 Retirement The Ultimate Guide Haws Federal Advisors

1

Fers Retirement Options Federal Employee S Retirement Planning Guide

Csrs Retirement And Pension Calculation Youtube

Fers Retirement Pension Plan Your Federal Retirement With A Cfp

Fers Retirement Calculator Youtube

Retirement

4 Last Minute Tax Tips Tax Brackets Saving For Retirement Income Tax

2

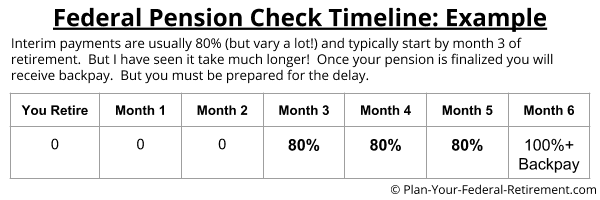

Your Federal Pension Check How Long Will It Take

Fers Retirement Options Federal Employee S Retirement Planning Guide

What Is The Fers Annuity And How Do I Compute Mine United Benefits

1

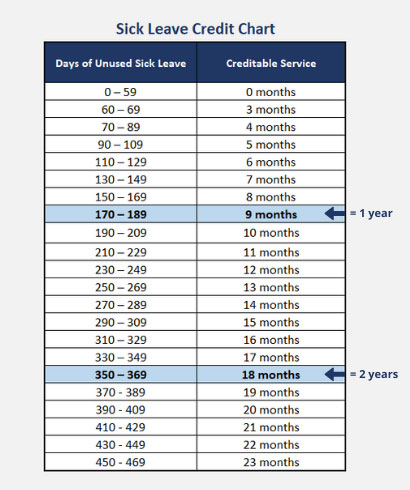

Calculating Service Credit For Sick Leave At Retirement

Understanding Your Fers Retirement Plan Your Federal Retirement